Blogs

Make sure you make sure the fine print of any credit credit before applying. Organization you to definitely excel within this class has large branch and you may Automatic teller machine communities and you may multiple examining and you may offers membership, plus they earn significantly more things to possess offering Dvds and money market account. I following scored for each business in line with the investigation items and metrics one to amount extremely so you can potential prospects. You could qualify with 5,100000 inside being qualified dumps otherwise an excellent 5,000 average everyday balance per month. It offers checking, discounts and you may certification out of deposit account, and personal loans, student education loans and mortgage loans.

Why does One Decrease the brand new Impression out of FD Untimely Withdrawal?

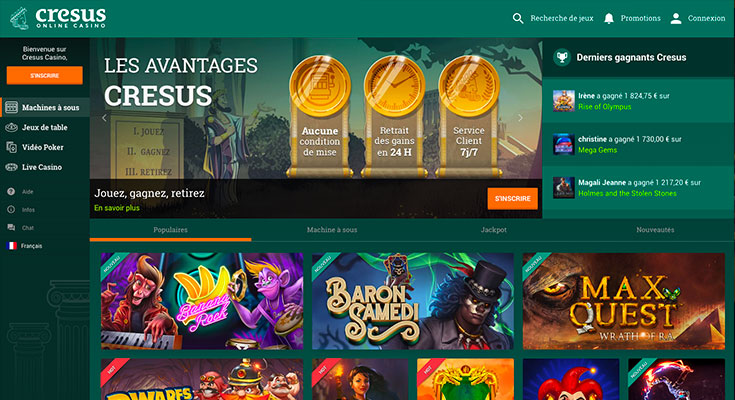

As with any local casino offers, no-deposit personal gambling establishment bonuses have a myriad of shapes and you may types and range from webpages to webpages. To pay off anything right up, I’ve detailed probably the most well-known form of no-deposit sweepstakes provides you with could possibly get run into from the societal and you may sweeps web sites inside the united states lower than. Even after just introducing in the 2023, the platform is very rapidly getting a household term. What’smore, like most greatest sweepstake casinos, McLuck offers a lot of promos, very zero a real income get are ever before necessary.

But not, a premature detachment of a keen FD of greater than ₹5 lakhs attracts a penalty of 1percent. The financing get depends upon the fresh debtor’s fees history. Consequently, and make a fixed deposit will get zero direct effect on their credit history. Yet not, you could constantly occupy a protected credit card against your most recent FD and shell out their expenses promptly to compliment the credit history.

- Have the current inside the private financing reports, also offers and pro information.

- However, on the web banks usually have prolonged solution instances and you will usage of pros through cellular phone, speak, or email address, leading them to far more versatile.

- Ally’s interest checking account doesn’t include of numerous costs, and the financial try upfront regarding the charge it does costs.

- When you’re carrying the new handbag if you it, it does deposit the bedroom back to the newest capture as opposed to allowing you to exit.

Should i Play Which Video slot To my Cell phone?

Checking account need zero starting https://happy-gambler.com/coinfalls-casino/ put requirements and stay in the united states available to show up on it list. Outside of the shortage of put and charges, of many checking accounts now include more benefits, such as cash back or budgeting systems. While they’re rare, certain 100 percent free checking accounts render cashback perks.

Wire import charges try fairly well-known, however don’t want hidden costs to own shedding lower than the very least harmony or using away-of-community ATMs. Comun try a newer fintech company that offers banking products and characteristics to the underbanked. They is designed to provide much more comprehensive financial features to own immigrants and you may their loved ones.

For many who really need to-break a term deposit, you obtained’t just be capable go surfing and you may tick a package. As the techniques may vary because of the bank, you will find what you should watch out for when you need to help you split an expression deposit. Essentially, even if, you could withdraw certain or all of the financing you deposited from the membership before label finishes, as long as you stick to the best actions and you may don’t brain investing a punishment.

Zero, income tax preserving fixed dumps normally have a good secure-within the period of 5 years and don’t enable untimely withdrawals. Fixed dumps (FDs) are a greatest investment option in the India making use of their security and you may glamorous production. Although not, there is instances where you must break your FD just before their maturity time.

Large 5 Gambling enterprise – Finest Full No deposit Sweeps Gambling enterprise

It’s uncommon to find a debit cards that have a bank account, you could request you to definitely with this membership to more readily availability your own finance. Since the Synchrony is actually an online bank, you’ll also have bullet-the-clock entry to their membership from the products. As opposed to offering a separate family savings, SoFi provides a blended checking and family savings. It doesn’t fees a monthly service payment or normal account costs, such as overdraft, returned-product or end-fee charge. SoFi’s most other savings account features tend to be as much as 50 inside the free overdraft coverage to the debit cards orders (if you have at least step one,000 directly in dumps 30 days). The newest membership does not have any month-to-month fees and you can pays 1percent cash return for the to 3,100000 inside debit credit sales every month.

According to your financial business, you’re able to availableness your own accrued Cd desire instead penalty. Certain establishments will allow you to availableness accumulated desire as opposed to penalty, providing you do not reach the primary. It indicates playing the new terms and conditions to the everything about your Video game purchases, away from interest rates to penalties. In addition, it setting having fun with savvy steps, including Cd laddering, to aid allow you to get the most from which saving vehicle’s balance and focus, while maintaining particular freedom.

Inside the 2012, SoFi introduced their Education loan Refinancing system to own federal and private student loans. Today, SoFi provides more six.9 million customers possesses prolonged its equipment offering to add lending, investing, individual banking, insurance rates, and much more. Untimely detachment out of repaired deposit is a type of density, tend to inspired by the unforeseen financial demands.

The lending company offers totally free access to over sixty,100 free Allpoint and you may MoneyPass ATMs, along with an extremely ranked application with have such a device you to assesses your investing. Yet not, Find doesn’t refund aside-of-network Automatic teller machine costs, also it fees 30 to own wire transmits. Your claimed’t be recharged by Connexus to have inside-community or out-of-system Atm deals, but the manager away from an away-of-circle Automatic teller machine you may ask you for. Thankfully, Connexus reimburses as much as twenty-five monthly inside Atm surcharges, considering your meet with the membership’s month-to-month conditions. Connexus Credit Partnership doesn’t charges members a payment for overdraft transfers away from linked membership.